Quote from investor.com A strong earnings report from JPMorgan (JPM) Friday got third-quarter earnings season off to a good start, with the major stock indexes at or near all-time highs. Now, a couple of longtime stock market leaders — Netflix (NFLX) and Intuitive Surgical (ISRG) — are coming up on the earnings calendar, along with artificial intelligence player Taiwan Semiconductor (TSM).

Next up on the agenda, however, is a slew of financial stocks, including Bank of America (BAC), Citigroup (C) and Goldman Sachs (GS), which report early Tuesday.

With many financial stocks near highs, the market doesn’t seem too concerned about weakening net interest margin as the yield curve flattens. When the yield curve is steep, banks can borrow money at lower rates and lend it out at higher rates. Net interest margin is the difference between interest income generated and the amount of interest paid out to lenders.

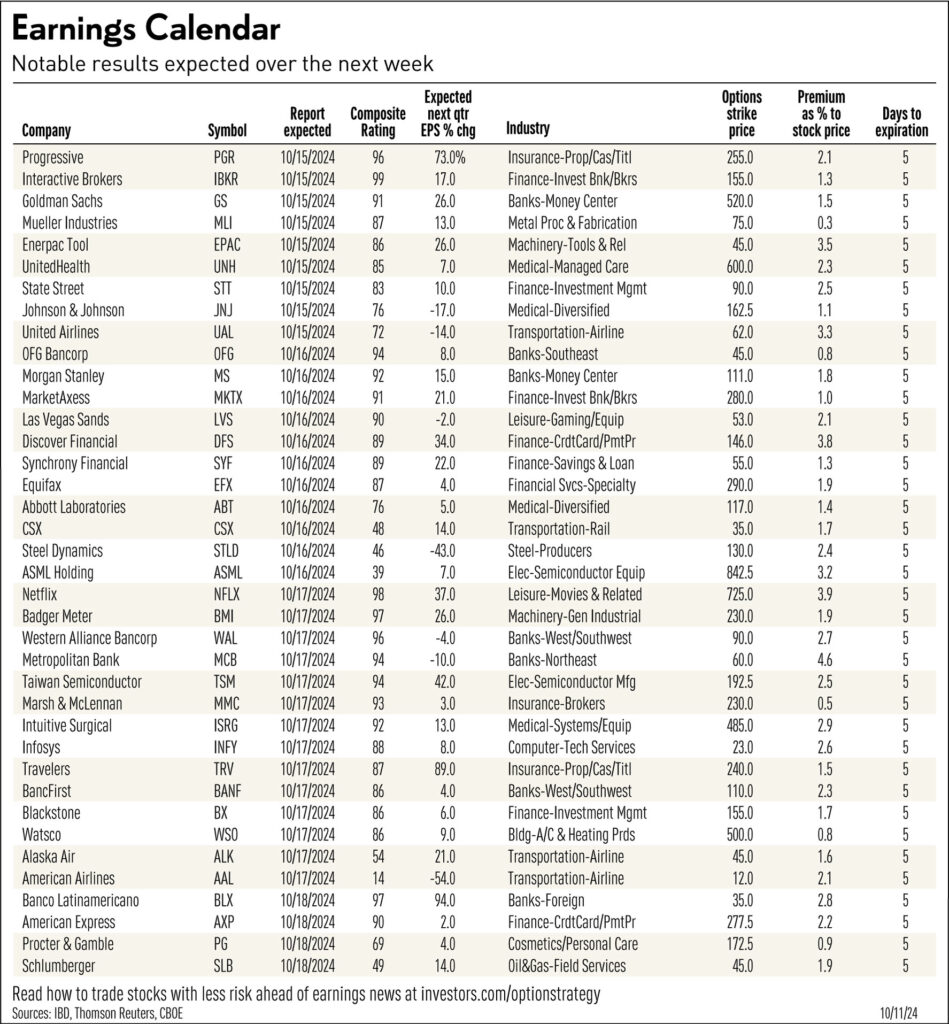

American Express (AXP) is also on the earnings calendar, with results due Friday before the open. American Express is holding near all-time highs, along with the Financial Select Sector SPDR (XLF) exchange traded fund. Further, AmEx is a top 10 holding with a weighting near 2.5%.

Revenue growth has been decelerating at American Express. After reporting a 10% increase in revenue for the second quarter, third-quarter revenue is expected to rise 8% to $16.7 billion, according to FactSet.

AmEx gapped down in July after revenue came in slightly below expectations. But the company increased its full-year earnings forecast to $13.30 to $13.80 a share, above a prior forecast of $12.65 to $13.15.

In June, AmEx bought restaurant booking firm Tock from Squarespace (SQSP) for $400 million in cash.

Earnings Calendar Spotlight

Meanwhile, Netflix and Intuitive Surgical are due to report Thursday after the close.

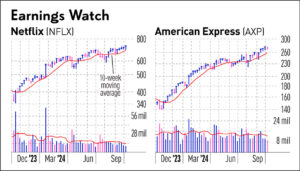

Recent earnings growth at Netflix has been helped, in part, by recent cost-cutting measures. A crackdown in password sharing, along with strong demand for its cheaper, ad-supported tier, has also fueled the bottom line.

In July, shares initially jumped after the company reported a 48% increase in quarterly profit. Revenue growth accelerated for the fourth straight quarter, rising 17% to $9.6 billion. But a 5.6% intraday gain faded to a loss of 1.5% by the close. The reversal came even as global paid memberships increased 16.5% year over year to 278 million, slightly above expectations. Ad-supported memberships jumped 34%.

In the first quarter, Netflix said it would stop providing quarterly membership numbers starting in 2025 as the company’s focus turns to revenue and operating margin.

For the third quarter, the company is expected to report adjusted profit of $5.10 a share, up 37%. Revenue is seen rising 14% to $9.8 billion.

Watching Intuitive Surgical, Taiwan Semi

Intuitive Surgical, which makes the da Vinci robotic surgical system, is still on a strong uptrend as it holds support at the 10-week moving average. Like Netflix, it’s another company with strong fundamentals.

Intuitive Surgical gapped up powerfully on July 19 after the company reported accelerating growth in second-quarter earnings and revenue, which were up 25% and 14%, respectively. The number of procedures using da Vinci climbed 17% year over year, topping projections for 15%, according to FactSet.

Bariatric surgeries performed by da Vinci, which modify the digestive system to regulate calorie intake, have been on the decline as GLP-1 weight-loss drugs increase in popularity. Intuitive offset weakness in this area by strength in Ion procedures for lung biopsy, which surged 80%.

Intuitive Surgical also has been busy launching its new da Vinci 5 system. In the second quarter, the company sold 70 of these next-generation systems, up sharply from eight in the first quarter.

In the semiconductor space, Taiwan Semi is also on the earnings calendar and reports early Thursday. The world’s largest chip foundry recently said that September revenue jumped nearly 40% in local currency.

Taiwan Semi is also a compelling growth story thanks to insatiable demand for artificial intelligence chips. The company counts Nvidia (NVDA), Broadcom (AVGO) and Apple (AAPL) as customers.

Watch for another quarter of accelerating earnings and revenue, with profit up 42% to $1.78 a share and revenue up 38% to $23.3 billion.

Options Trading Strategy

A basic options trading strategy around earnings — using call options — allows you to buy a stock at a predetermined price without taking a lot of risk. Here’s how the option trading strategy works, and what a call-option trade recently looked like for Netflix.

First, identify top-rated stocks with a bullish chart. Some might be setting up in sound early-stage bases. Further, others already might have broken out and are getting support at their 10-week lines for the first time. And a few might be trading tightly near highs and refusing to give up much ground. Avoid extended stocks that are too far past proper entry points.

A call option is a bullish bet on a stock. Put options are bearish bets. One call option contract gives the holder the right to buy 100 shares of a stock at a specified price, known as the strike price.

Once you’ve identified a bullish setup in the earnings calendar, check strike prices with your online trading platform, or at Cboe.com. Also, make sure the option is liquid with a relatively tight spread between the bid and ask.

Look for a strike price just above the underlying stock price — that’s out of the money — and check the premium. Ideally, the premium should not exceed 4% of the underlying stock price at the time. In some cases, an in-the-money strike price is OK as long as the premium isn’t too expensive.

Choose an expiration date that fits your risk objective. But keep in mind that time is money in the options market. Near-term expiration dates will have cheaper premiums than those further out. Buying time in the options market comes at a higher cost.

Earnings Calendar Option Trade

Netflix, which was recently still in a buy zone from a 711.33 entry, could make sense for a call option trade

When the stock traded around 731, a slightly out-of-the-money weekly call option with a 732.50 strike price and an Oct. 25 expiration came with a premium of around $33 per contract. That was 4.5% of the underlying stock price at the time, slightly above the 4% threshold of IBD’s strategy. Keep in mind, though, that Netflix tends to move a lot, one way or the other, on earnings.

One contract gave the holder the right to buy 100 shares of Netflix at 732.50 per share. The most that could be lost was $3,300 — the amount paid for the 100-share contract. To break even, Netflix stock would need to rise to 765.50, factoring in the premium paid.

The expected move in the options market for Netflix, based on the at-the-money strike price of 730, was about 60 points up or down. This was determined by adding the at-the-money call premium along with the put premium for the Oct. 18 contract.

Keep in mind this is not a trade for a small portfolio. In the above scenario, exercising one contract and taking delivery of 100 shares would cost $73,250.

No comment